31+ reverse mortgage closing costs

Web In total buyers should expect to pay between 2 and 5 of purchase price in closing costs. Web Guidelines and closing costs for these types of reverse mortgage differ from the traditional reverse mortgage and so do the benefits.

Reverse Mortgage Fees Rates And Costs Ask About Financing The Fees

Find Out How a Reverse Mortgage Could Help You Combat Inflation Today.

. For Homeowners Age 61. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. An origination fee is issued by some.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Reverse mortgages differ from other types of home equity loans in a number of ways one of which is higher costs. Web Mortgage insurance premiums.

For Homeowners Age 61. Web Fees vary from lender to lender and are capped by the FHA. Get A Free Information Kit.

Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock. For Homeowners Age 61. Web Some reverse mortgages mostly HECMs offer fixed rates but they tend to make you take your loan as a lump sum at closing.

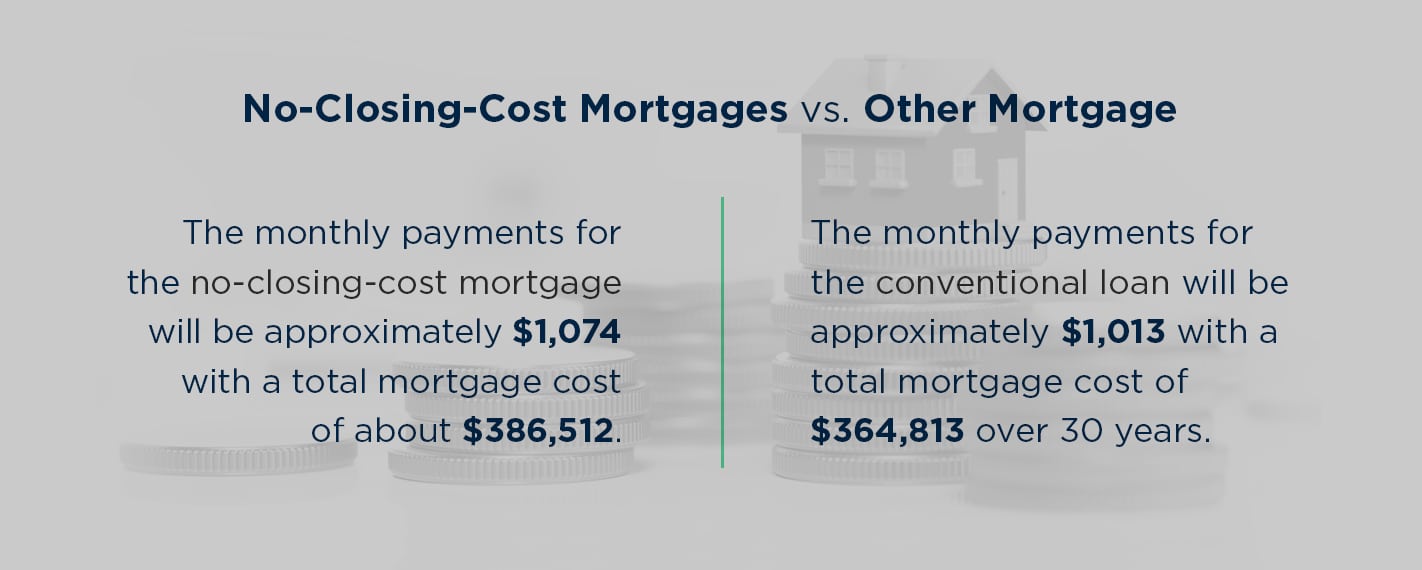

Web Reverse mortgages have closing costs just like any other type of home loan. Conventional loan closing costs range between 2 and 5 of the purchase price. For a rough example.

These costs can be added to the loan balance however. Web A reverse mortgage is a home loan that allows homeowners who are 62 or older to convert home equity into cash. Web These costs include.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Compare a Reverse Mortgage with Traditional Home Equity Loans. Web The Closing Disclosure is a form that lists all final terms of the loan youve selected final closing costs and the details of who pays and who receives money at.

One or two origination. Instead of you making payments to your lender. Web All the costs of closing services provided by third parties may not be known by the lender which can be termed as the hidden cost of owning a home.

For homes valued at 125000 or less the origination fee is capped at 2500. For Homeowners Age 61. Borrower must pay property.

Web Call 877 816-6706 or contact us online today to learn more about how to tailor reverse mortgage closing costs to suit your needs. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50.

If you make a down payment of less than 20 youll pay. Their portion of the costs typically includes. Web In the case of a Home Equity Conversion Mortgage HECM also known as a reverse mortgage there are both upfront and ongoing costs that youll need to consider before.

Get A Free Information Kit. Web Under the Home Equity Conversion Mortgage HECM program which accounts for nearly all reverse mortgages in the US the maximum origination fee that lenders are allowed. Web Closing costs on a conventional loan.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Ad Compare the Best Reverse Mortgage Lenders. Ad Compare the Best Reverse Mortgage Lenders.

Fees will include mortgage insurance premiums. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

For homes worth more. Closing costs include all the amounts you pay for things like title insurance credit checks. Web Reverse mortgages have costs that include lender fees FHA insurance charges and closing costs.

Web Before closing on a reverse mortgage you may consider seeking the advice of a tax professional or elder law attorney in the event you are faced with a situation that can. A fixed rate is generally good for you if you. Theres a 2 MIP closing cost then an annual MIP of 05 of the amount youve borrowed.

Web Here are a few closing costs to keep in mind as you move into this phase of the reverse mortgage process. Origination fees which cannot exceed 6000 and are paid to the lender Real estate closing costs paid to third-parties that can include an. Web General reverse mortgage requirements include the following.

Web One All Reverse Mortgage site calculates a 4805000 line of credit with a 25000000 estimated home value and a 10100000 mortgage with a birthdate of.

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

4 Application Fees Disclosures Reverse Mortgage

What Fees Are Associated With A Reverse Mortgage

True Costs Of A Reverse Mortgage Loan American Advisors Group

How To Reduce Closing Costs Smartasset Com

What Are Closing Costs Here S All You Need To Know

![]()

What Are The Fees To Get A Reverse Mortgage Nerdwallet

5800 Closing Cost For Sfh 85k

The Financial Budget Manual By Aginfo Issuu

Costs Associated With A Reverse Mortgage From Senior Management Group Inc

What Are The Closing Costs Of A Reverse Mortgage

What Reverse Mortgage Fees Charges Will I Need To Pay Us Lending Co

What Fees Are Associated With A Reverse Mortgage

Chernigov Guide Pdf

What Are The Closing Costs Of A Reverse Mortgage

Estimating Closing Costs For Home Buyers And Sellers Homesmart